Foreign exchange rates are among the most valuable financial variables, influenced by countless factors including political events, macroeconomic indicators, and investor sentiment. Traders and analysts constantly seek ways to forecast these rates. Traditional statistical methods have proven useful for analyzing financial data, but deep learning models—particularly Recurrent Neural Networks (RNNs) which often excel in time sequence prediction. In this report, we explore how these models can be used to predict the USD/ZAR currency pair while also examining their strengths and weaknesses in handling sequential data.

Time series forecasting revolves around predicting future values based on historical data. Standard regression models often assume independence between observations in the form of a linerar relationship. Wheras, deep learning models learn unique relationships or patterns within the data without extensive feature engineering, making them particularly effective for forecasting financial variables. Traditional methods that are often based on linear models, which may not capture the nonlinear trends, or sudden changes caused by unforeseen economic shifts. Hence, deep learning models are increasingly favored for predicting currency exchange.

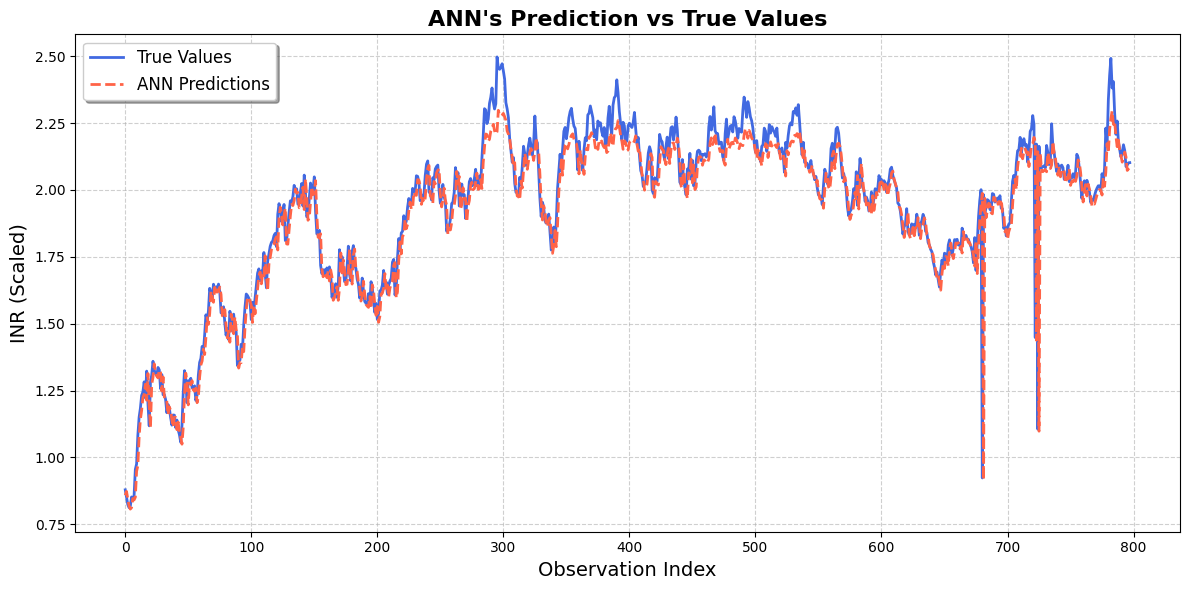

Traditionally used for regression tasks, Artificial Neural Networks (ANNs) can also be applied to time series forecasting. While Artificial Neural Networks (ANNs) can be applied to sequential data, they are not inherently designed for it and often struggle with capturing the dependencies and order of elements within sequences. This is because ANNs lack the feedback loop to maintain a hidden state and process elements in a sequence sequentially.

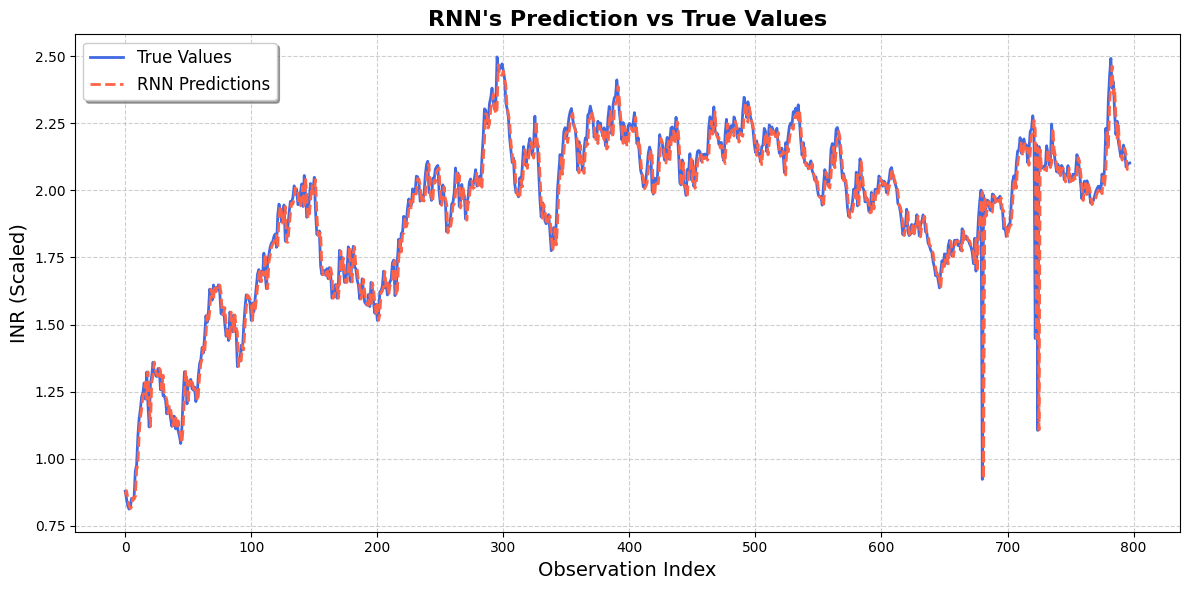

Recurrent Neural Networks are specifically designed to handle sequential data. Unlike traditional feedforward networks, RNNs maintain a hidden state that captures dependencies between past observations and future outcomes, making them well-suited for modeling patterns in exchange rates—where cyclical trends or short-term momentum shifts are common. However, basic RNNs suffer from the vanishing gradient problem, where the impact of earlier observations diminishes over long sequences.

The vanishing gradient issue in RNNs makes it difficult to learn long-term dependencies. To overcome this, Sepp Hochreiter and Jürgen Schmidhuber introduced Long Short-Term Memory (LSTM) networks. LSTMs incorporate memory cells and gating mechanisms (input, forget, and output gates) to control the flow of information. These features allow LSTMs to retain relevant historical data over long sequences, making them especially suitable for predicting financial variables where long-term trends and macroeconomic factors play a significant role.

Gated Recurrent Units (GRUs) are a streamlined to LSTMs, maintaining much of their effectiveness while reducing computational complexity. GRUs consolidate the forget and input gates into a single gating mechanism, which speeds up training while still capturing sequential dependencies effectively. For USD/ZAR forecasting, GRUs offer efficient modeling of time series patterns, making them particularly useful for capturing short-term fluctuations driven by market or political events.

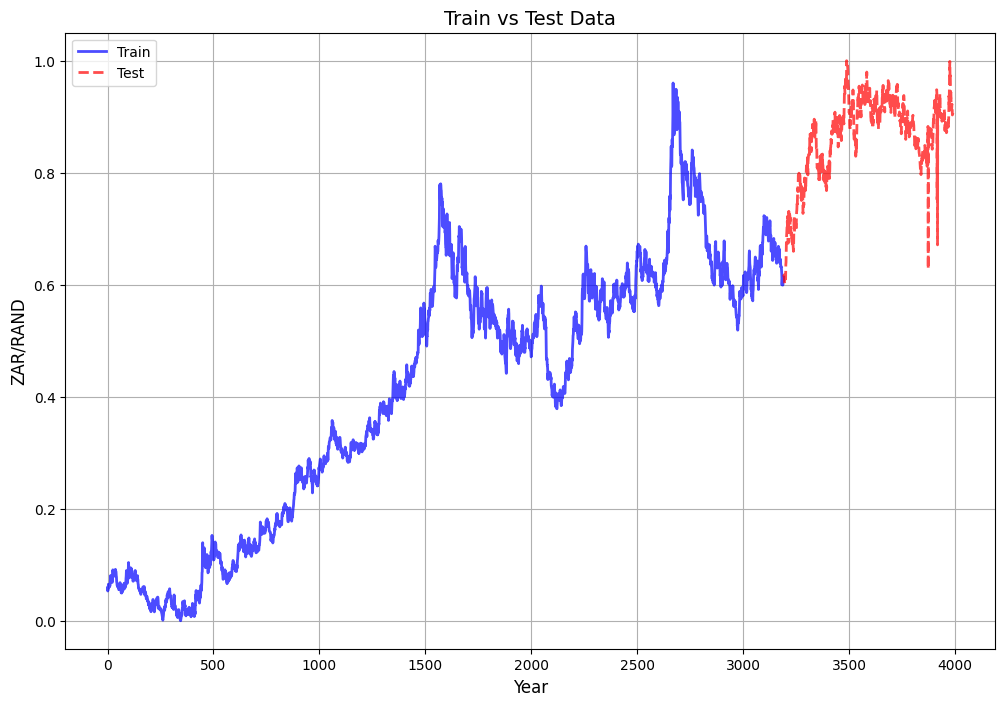

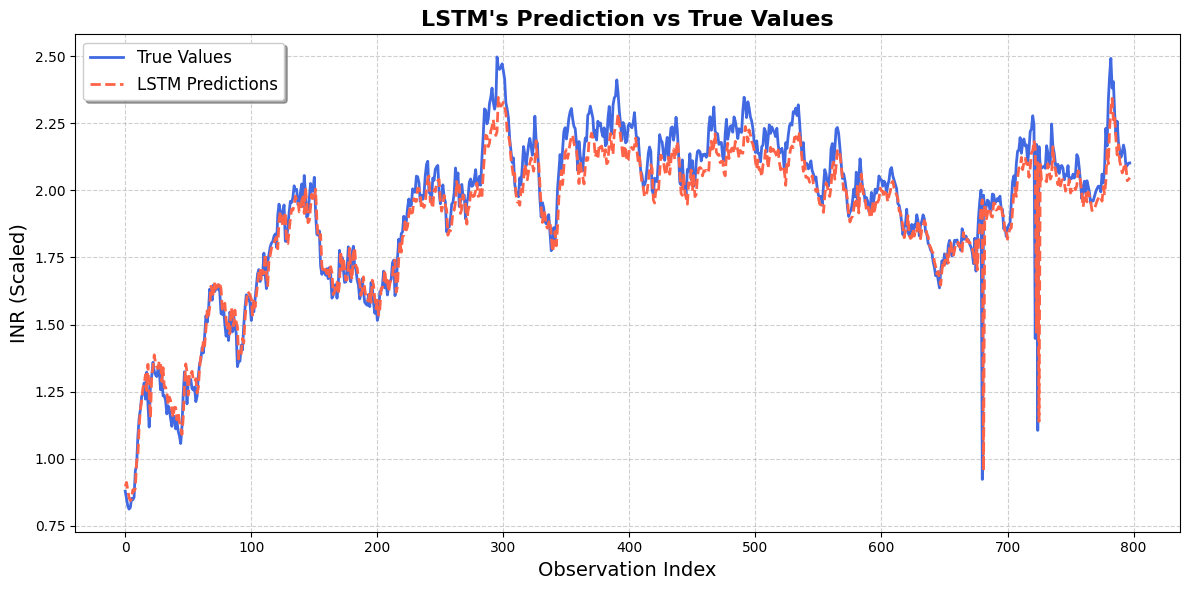

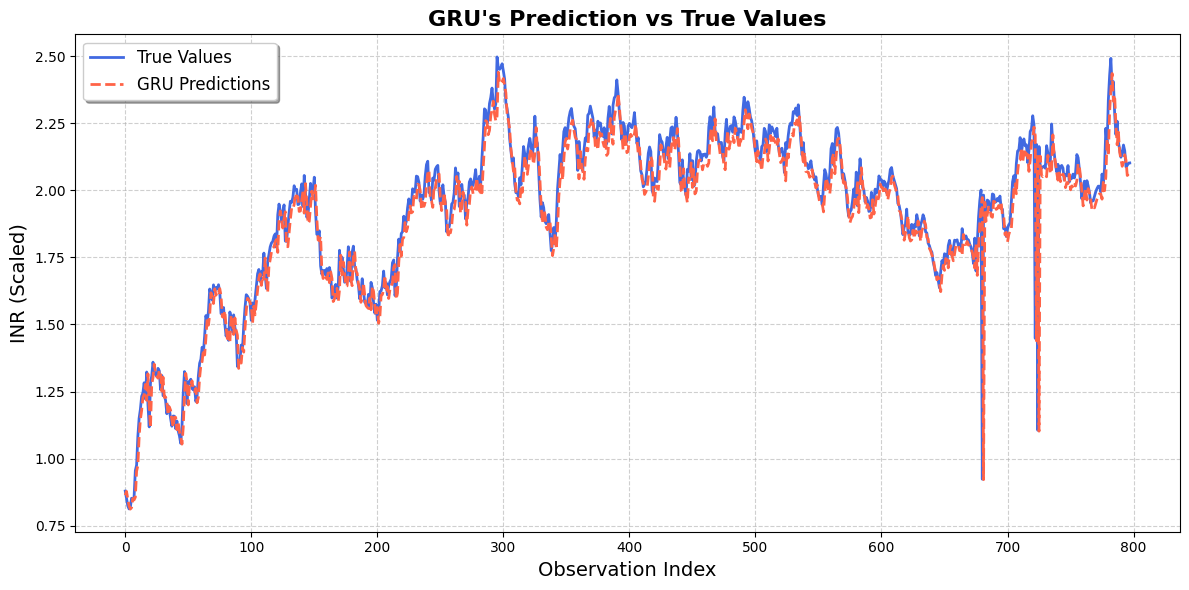

In this experiments, models were trained on USD/ZAR exchange rate data from 2010 to 2025, and then used to predict the following five years. Notably, the ANN and the RNN performed surprisingly well compared to the LSTM model, with the GRU delivering the best overall performance.

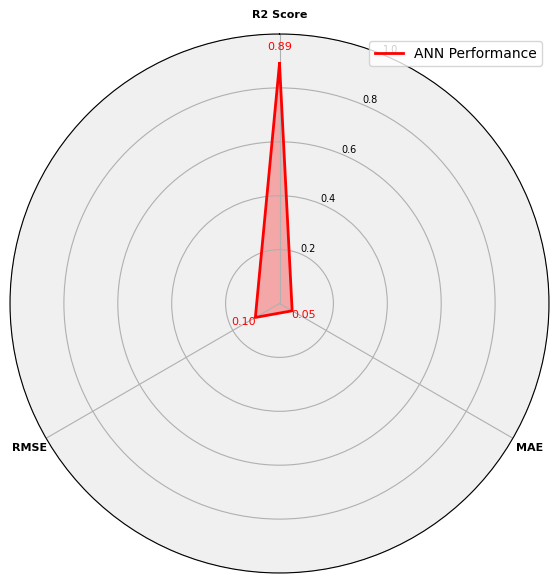

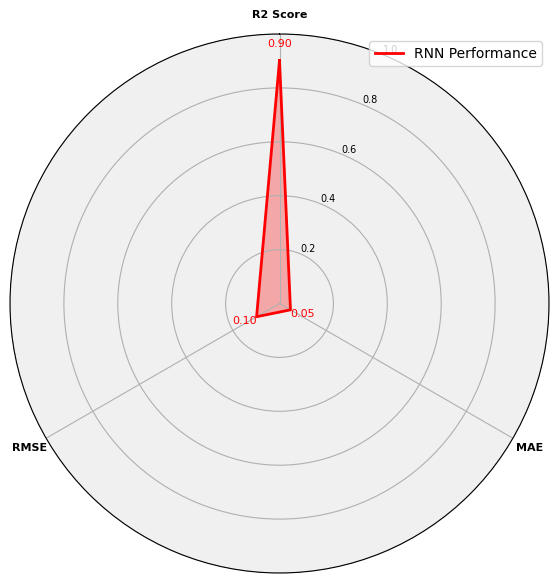

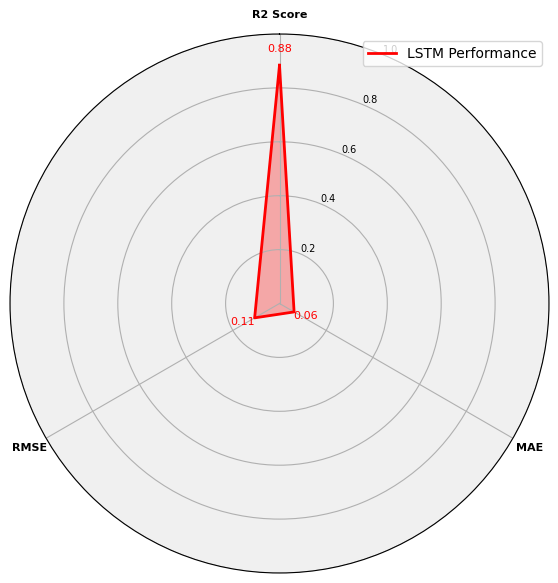

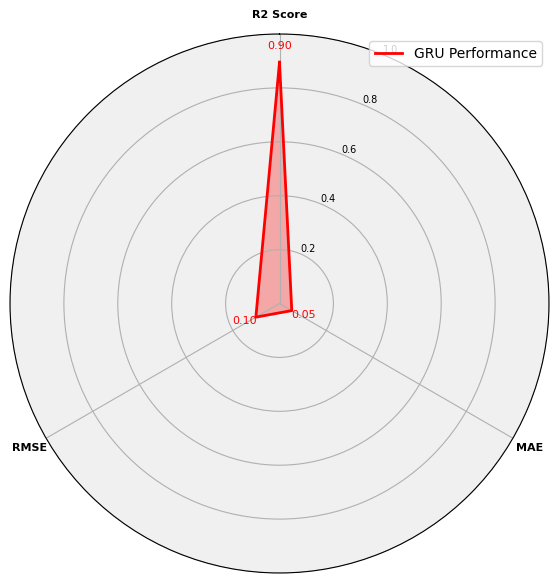

Looking at the radar plots, the R² score quantifies the proportion of variance in the dependent variable that can be predicted from the independent variables, essentially indicating how well the model explains the observed outcomes. When evaluating a regression model, the ideal scenario is to have a high R² score combined with low RMSE and MAE values. A high R² score demonstrates that the model captures a significant portion of the variance in the data, while low RMSE and MAE values confirm that predictions are accurate and errors are minimal. In this analysis, the ANN model exhibits a high R² score, indicating strong accuracy alongside low RMSE and MSE. Although the LSTM model produces similar outcomes, its R² score is somewhat lower than that of the ANN, suggesting that the ANN performs better. On the other hand, both the RNN and GRU models achieve the highest R² scores, signifying even better predictive performance overall.

The USD/ZAR exchange rate experienced significant fluctuations from 2010 to 2025 due to economic, political, and global events. From 2010 to 2020, the Rand weakened steadily from around 7.30 ZAR/USD to about 15.00 ZAR/USD, influenced by economic uncertainty, commodity price volatility, political instability, and the COVID-19 pandemic. From 2020 to 2025, the Rand fluctuated between approximately 18.08 and 19.75 ZAR/USD, showing signs of stabilization as the financial environment became more controlled through post-pandemic recovery, interest rate adjustments, geopolitical shifts, and commodity market rebounds.

These outcomes suggest that while RNNs and LSTMs are traditionally favored for their ability to capture long-term dependencies, under specific conditions ANNs and GRUs can outperform them. One possible explanation is that the data complexity and training efficiency allowed a well-tuned ANN to extract meaningful patterns for short-term prediction. Additionally, the simplified design of GRUs makes them more computationally efficient, especially when dealing with datasets exhibiting shorter temporal dependencies or less noise. Hyperparameter tuning and training optimizations are also critical factors that can influence model performance.

Ultimately, selecting the right model depends on the nature of the financial data and the desired forecasting horizon. Financial markets are inherently complex and are influenced by an array of economic and political factors. Consequently, while deep learning models provide valuable insights for forecasting, they should be complemented with domain expertise and fundamental analysis to achieve optimal trading decisions.